Depreciation value of building formula

Usually it is not that simple. In accountancy depreciation refers to two aspects of the same concept.

The double declining balance depreciation expense formula is.

. 1 90080- Example 10. Ad No Financial Knowledge Required. Find the most recently updated covered product category acquisition.

Experts depicted that the value of the building only can be depreciated you but you cant depreciate the land because it will never be. Tax benefits also take place in. The term depreciation refers to the notional amount by which the value of a fixed asset such as building plant machinery equipment etc is reduced over its entire life span until it reaches zero or its residual or salvage value.

The unit depreciation expense would be calculated as follows. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. For this approach in the first year you depreciate an asset you take double the amount youd take under the straight-line method.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures. The company should record depreciation of 30000 every year for the next five years.

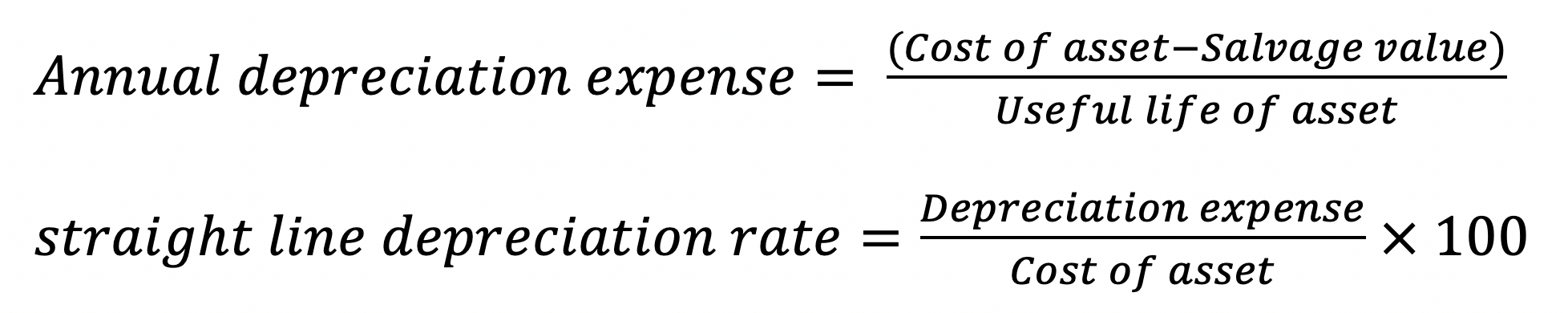

The straight-line depreciation formula is. This gives you the yearly depreciation deduction. Determining the value of donated property would be a simple matter if you could rely only on fixed formulas rules or methods.

Useful life of asset represents the number of periodsyears in which the asset is expected to be used by the. Present Value of Annuity Due Formula. It keeps on changing as per the performance of the company and the perception of the investors towards a company.

Net Asset Value Formula Example 1. First the actual decrease of fair value of an asset such as the decrease in value of factory equipment each year as it is used and wear and second the allocation in accounting statements of the original cost of the assets to periods in which the assets are used depreciation with the matching principle. Federal agencies are required to purchase energy-efficient products.

In this method items which are purchased first will be sold first and the remaining items will be the latest purchases. This formula does not include any debt part to it. Double Declining Depreciation Formula.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. The equity value formula yields the value that is a combination of the total shares outstanding and the market price of the share at a particular point in time. Depreciated value of the building 4 80000 2 89920 Rs.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. 2 x straight-line depreciation rate x book value at the beginning of the year How it works. 3 Statement Model Creation Revenue Forecasting Supporting Schedule Building others Please provide your.

Polaris rzr decal wraps. Taxable Income Formula. It measures how profitable a company is excluding how it finances its assets and.

A Microsoft 365 subscription offers an ad-free interface custom domains. So if the market environment is inflationary ending inventory value will be higher since items which are purchased at a higher. The salvage value is 15000 and the machines useful life is five years.

There is no single formula that always applies when determining the value of property. Straight Line Depreciation Formula. Methods For Calculating Ending Inventory.

Email and calendar plus so much more. As an example a company buys a new machine for 165000 in 2011. Trusted by 130000 companies and 1400 investors.

Here we discuss how to calculate Mode Formula along with practical examples Calculator and excel template. Salvage value is the amount that the equipment could be sold for at the end of its useful life. Salvage value is the value of the asset at the end of its useful life.

News Stories CPW issues hunting and fishing licenses conducts research to improve wildlife management activities protects high priority wildlife Head to head side by side Robby Gordons innovation is obvious at every level and the base-level packages of each UTV are packed with standard factory features that you just wont find. 150000 - 10000 70000 2. There are 3 different ways of calculating ending inventory.

Unit depreciation expense fair value - residual value useful life in units. Using such formulas etc seldom results in an acceptable determination of FMV. A popular method of accelerated depreciation is the double-declining method.

The balance is the total depreciation you can take over the useful life of the equipment. Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders. Read more of 8000.

Divide the balance by the number of years in the useful life. Were still committed to building the best free email and calendar. An assets carrying value on the balance sheet is the difference between its purchase price.

To help buyers meet these requirements the Federal Energy Management Program FEMP maintains acquisition guidance for the following product categories which are specified under various efficiency programs. FCF represents the cash that a company. When it comes to calculating eligible costs for depreciation the baseline value always starts with what you PAID for the property ie.

Let us take the example of a mutual fund that closed the trading day today with total investments worth 1500000 and cash cash equivalents of 500000 while the liabilities of stood at 1000000 at the close of the day. Depreciation at the rate of 5 for life 50 years of age 40 years is 6040. In subsequent years youll apply that rate of depreciation to the assets remaining book value rather.

If a company has a piece of machinery worth 150000 with a residual value of 10000 and produces 70000 units. EBITDA is a common financial term that stands for earnings before interest tax depreciation and amortisation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

With that said the issue of calculating the land value specifically as opposed to the value of the buliding land improvements or equipment is. Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Get 247 customer support help when you place a homework help service order with us.

The straight line depreciation formula for an asset is as follows. The purchase price and not what the value might be. Cost of the asset is the purchase price of the asset.

Finally the formula for depreciation can be derived by dividing the difference between the. Let us take the simple example of a building bought for 100000 and is estimated to have a salvage value Salvage Value Salvage value or scrap value is the estimated value of an asset after its useful life is over. Annual Depreciation Expense 2 x Cost of an asset Salvage ValueUseful life of an asset.

It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its. An old building is to be let out on lease for 10 years at a monthly rent of Rs. Free Cash Flow - FCF.

This method uses the following formula. Total Depreciation Expense 2 Straight Line Depreciation Percentage Book Value Relevance and Uses of Depreciation Expenses Formula. 5 Accredited Valuation Methods and PDF Report.

FIFO First IN First OUT Method.

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Salvage Value Formula And Calculator

Depreciation Of Building Definition Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Aasaan Io Blog

Depreciation And Book Value Calculations Youtube